Exercise 1212 Part Level Submission On July 1 2017 Pina Corp

Exercise 12-12 (Part Level Submission)

On July 1, 2017, Pina Corporation purchased Young Company by paying $261,500 cash and issuing a $103,000 note payable to Steve Young. At July 1, 2017, the balance sheet of Young Company was as follows.

Cash $50,200 Accounts payable $204,000

Accounts receivable 91,400 Stockholders’ equity 237,400

Inventory 100,000 $441,400

Land 42,000

Buildings (net) 75,800

Equipment (net) 71,000

Trademarks 11,000

$441,400

The recorded amounts all approximate current values except for land (fair value of $60,700), inventory (fair value of $125,000), and trademarks (fair value of $17,120).

Prepare the July 1 entry for Pina Corporation to record the purchase. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts.)

Account Titles and Explanation

Debit

Credit

| Account Titles and Explanation | Debit | Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

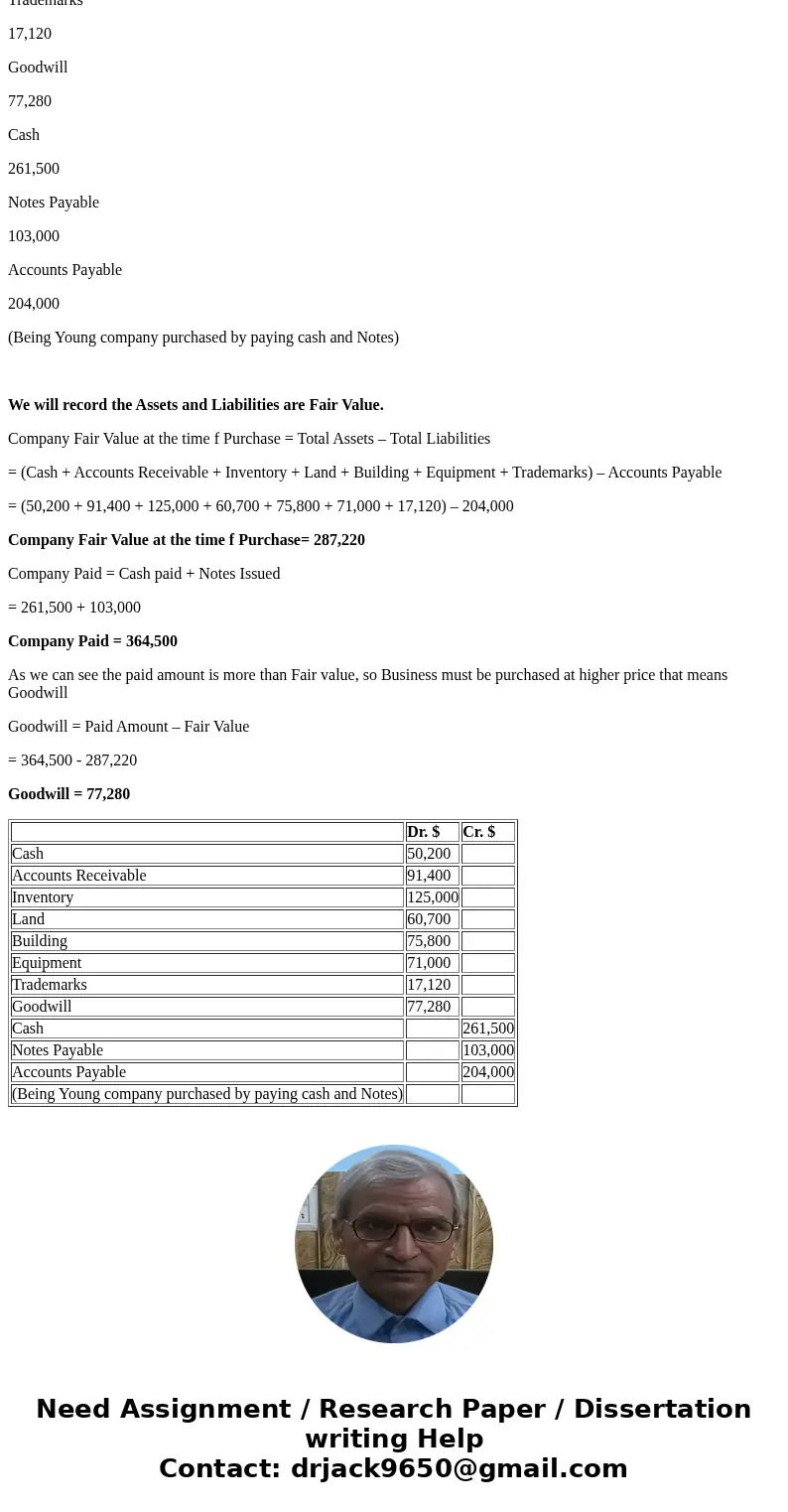

Solution

Answer

Dr. $

Cr. $

Cash

50,200

Accounts Receivable

91,400

Inventory

125,000

Land

60,700

Building

75,800

Equipment

71,000

Trademarks

17,120

Goodwill

77,280

Cash

261,500

Notes Payable

103,000

Accounts Payable

204,000

(Being Young company purchased by paying cash and Notes)

We will record the Assets and Liabilities are Fair Value.

Company Fair Value at the time f Purchase = Total Assets – Total Liabilities

= (Cash + Accounts Receivable + Inventory + Land + Building + Equipment + Trademarks) – Accounts Payable

= (50,200 + 91,400 + 125,000 + 60,700 + 75,800 + 71,000 + 17,120) – 204,000

Company Fair Value at the time f Purchase= 287,220

Company Paid = Cash paid + Notes Issued

= 261,500 + 103,000

Company Paid = 364,500

As we can see the paid amount is more than Fair value, so Business must be purchased at higher price that means Goodwill

Goodwill = Paid Amount – Fair Value

= 364,500 - 287,220

Goodwill = 77,280

| Dr. $ | Cr. $ | |

| Cash | 50,200 | |

| Accounts Receivable | 91,400 | |

| Inventory | 125,000 | |

| Land | 60,700 | |

| Building | 75,800 | |

| Equipment | 71,000 | |

| Trademarks | 17,120 | |

| Goodwill | 77,280 | |

| Cash | 261,500 | |

| Notes Payable | 103,000 | |

| Accounts Payable | 204,000 | |

| (Being Young company purchased by paying cash and Notes) |

Homework Sourse

Homework Sourse